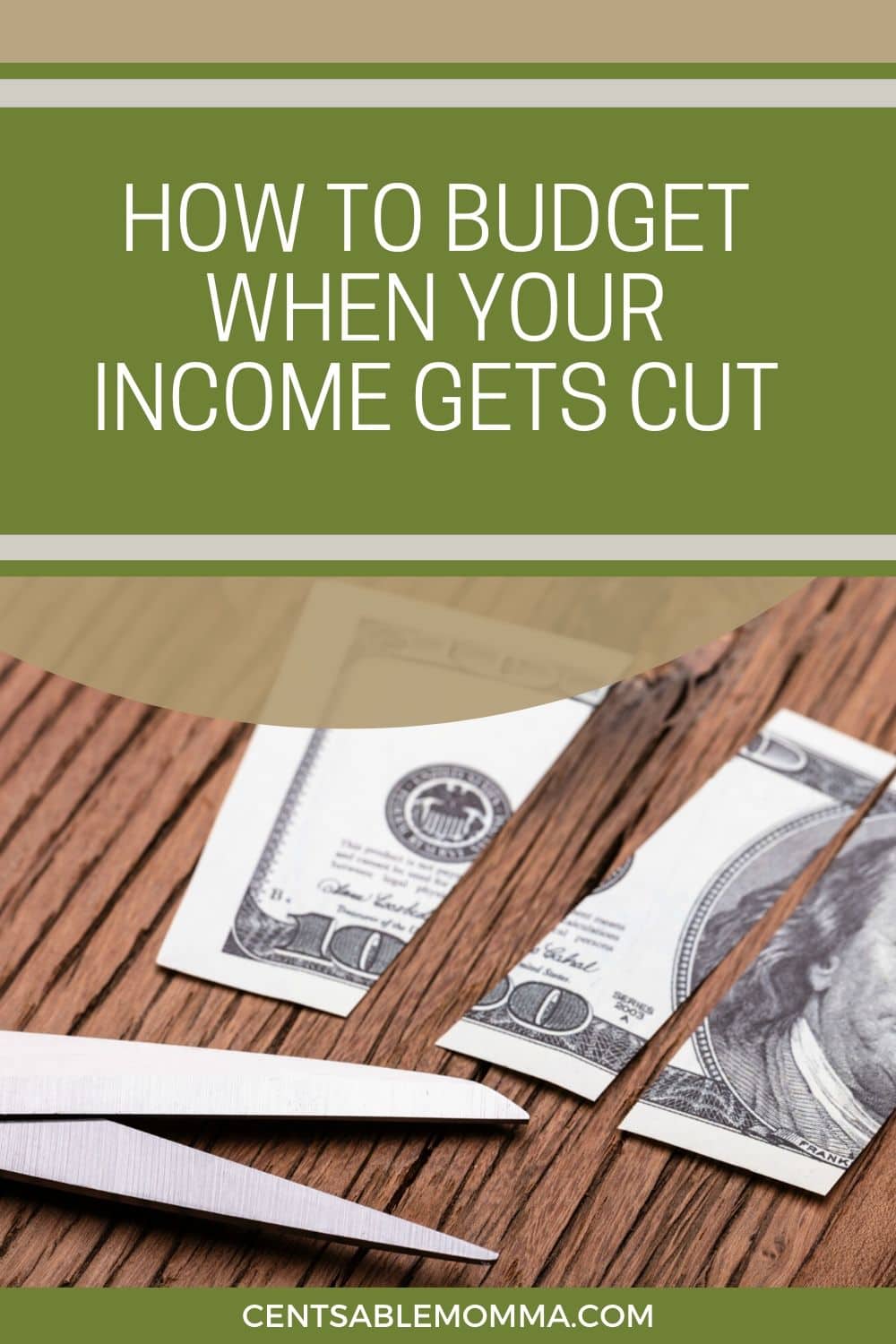

Many people will experience tough times at least once in their lifetime. Having your hours cut or having to take a job that pays less than your previous job can be difficult.

Difficult doesn’t mean impossible, though. There are ways to make it through a reduction of your income. Let’s take a closer look at how to budget when your income gets cut.

Explain the Situation to Your Family

Sit down and talk to your family about what’s going on. It’s better for kids to be in on what’s going on so that they can better understand. Explain that less money is coming into the home and you’ll have to make some changes to save money.

However, you'll want to adjust what you're saying to your kids depending on their ages. You don't want them to worry about the situation but just know that you're going to have to say "no" to some things as a family.

Switch to a Bare Bones Budget

Depending on how drastically your income has been cut, you'll want to make sure you have the important things covered first - like food, utilities, shelter, and transportation. After those things are covered, you can see how much additional money you have to budget for other things like debt, etc. But, don't put credit card payments over providing food, electricity/water, housing, and transportation to your job for your family.

Cut Unnecessary Expenses

You want to look over your bank statements to see where your money goes. Cut anything that isn’t necessary.

For example, if you have cable or satellite, get rid of it. You can watch a lot of free TV and movies through streaming services. You can reduce your cellphone bill by switching to a prepaid carrier, such as Straight Talk. You can even cut your grocery bill by cutting back on junk food and convenience foods.

During this time, you definitely don't want to waste money on eating out. You may even be able to go without buying new clothing if you can live with the items you have for a period of time.

Make Note of What You Have on Hand

If you have a stockpile, now is the time to use it. Go through and see what you have and utilize it. This is what a stockpile is for, to get you through the hard times. Plan meals around what you have on hand. Only buy what you need. Meals might get weird toward the end, but hopefully you’ll be back on your feet by then.

Apply for Unemployment Benefits

If your income has been cut because your hours have been reduced, you may be eligible for unemployment benefits if the reduction in hours is due to no fault of your own. Or if you've been laid off, be sure to apply for unemployment benefits with your state as soon as possible.

Create Additional Income

There are so many ways to create additional income. Something very simple to do is to sell items you’re no longer using. You can sell through eBay, Mercari, Poshmark, Facebook Marketplace, or even have a yard sale. You might not think the things you own are worth much, but you’d be surprised.

Save Your Emergency Fund as Long as Possible

Try not to use your emergency fund until you absolutely have to. An emergency fund is there for times like this, but the longer you can go without using it, the better. This should only be used to cover the most important expenses. It should not be used to continue living your previous lifestyle.

When your income gets cut, it’s only natural to panic. Thankfully, there are ways to adjust your budget to help you make it through.

Leave a Reply